Debtor Turnover Days Formula

Days Payable Outstanding DPO measures the number of days a company takes on average before paying outstanding suppliervendor invoices for purchases made on credit. Asset Turnover Ratio is a measure that is used to determine how efficiently a company is generating revenues from its assets.

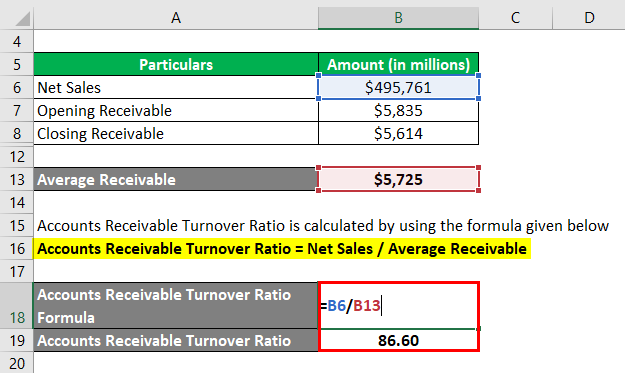

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

The formula for a stock turnover ratio can be derived by using the following steps.

. If we divide 30k by 200k we get 15 or 15. This is the average number of days it takes customers to pay their debt. It is also known as Days Sales.

Explanation of Asset Turnover Ratio Formula. This means that once a company has made a sale it takes 55. RoE 01 x 287 x 15.

Lets say a company has an AR balance of 30k and 200k in revenue. Formula for Receivable Turnover. RoE 04305 or 4305.

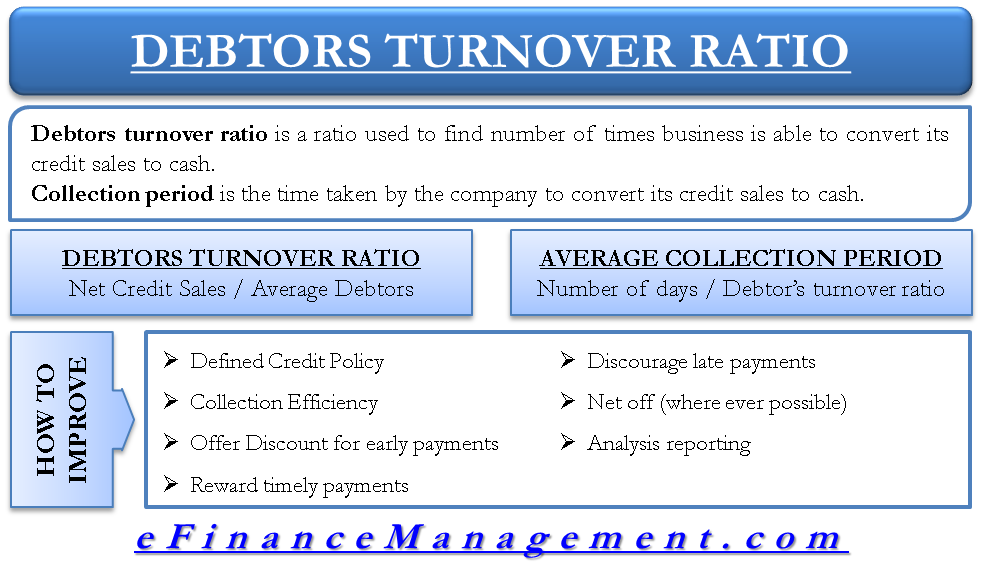

To calculate the AR turnover down to the day divide your ratio by 365. RoE Profit Margin x Asset Turnover x Financial Leverage. Debtor Receivable Turnover Ratio Credit Sales Average Debtors Average Bills Receivables Formula for Average Collection Period.

We then multiply 15 by 365 days to get approximately 55 for DSO. The DPO metric is oftentimes a proxy for the bargaining power of the buyer which is the extent to how much a company can exert pressure in negotiating favorable terms with suppliersvendors. Hence a higher ratio for asset turnover is a good sign.

Apple Inc Balance sheet Explanation. The AR turnover ratio is an efficiency ratio that measures how many times a year or set accounting period that a company collects its average accounts receivable. Days Sales Outstanding DSO Average Accounts Receivable Revenue 365 Days.

Average Collection Period 365 Days or 12 Months Debtor Receivable Turnover Ratio For calculation of the receivable turnover ratio you can use our. Firstly determine the cost of goods sold incurred by the company during the periodIt is the sum of all the direct and indirect costs that can be apportioned to the job order or product.

Receivable Turnover Ratio Formula Meaning Example And Interpretation

Accounts Receivable Turnover Ratio Accounting Play

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

How To Improve Receivable Turnover Ratio Collection Period

0 Response to "Debtor Turnover Days Formula"

Post a Comment